Invest in what matters most

Impact Portfolio Tracking for Private Equities

Impact Reporting is the only impact portfolio tracker that shows you what’s working, what’s not, and where to invest to make an even bigger impact.

Impact Reporting is the only impact portfolio tracker that shows you what’s working, what’s not, and where to invest to make an even bigger impact.

With Impact, you can…

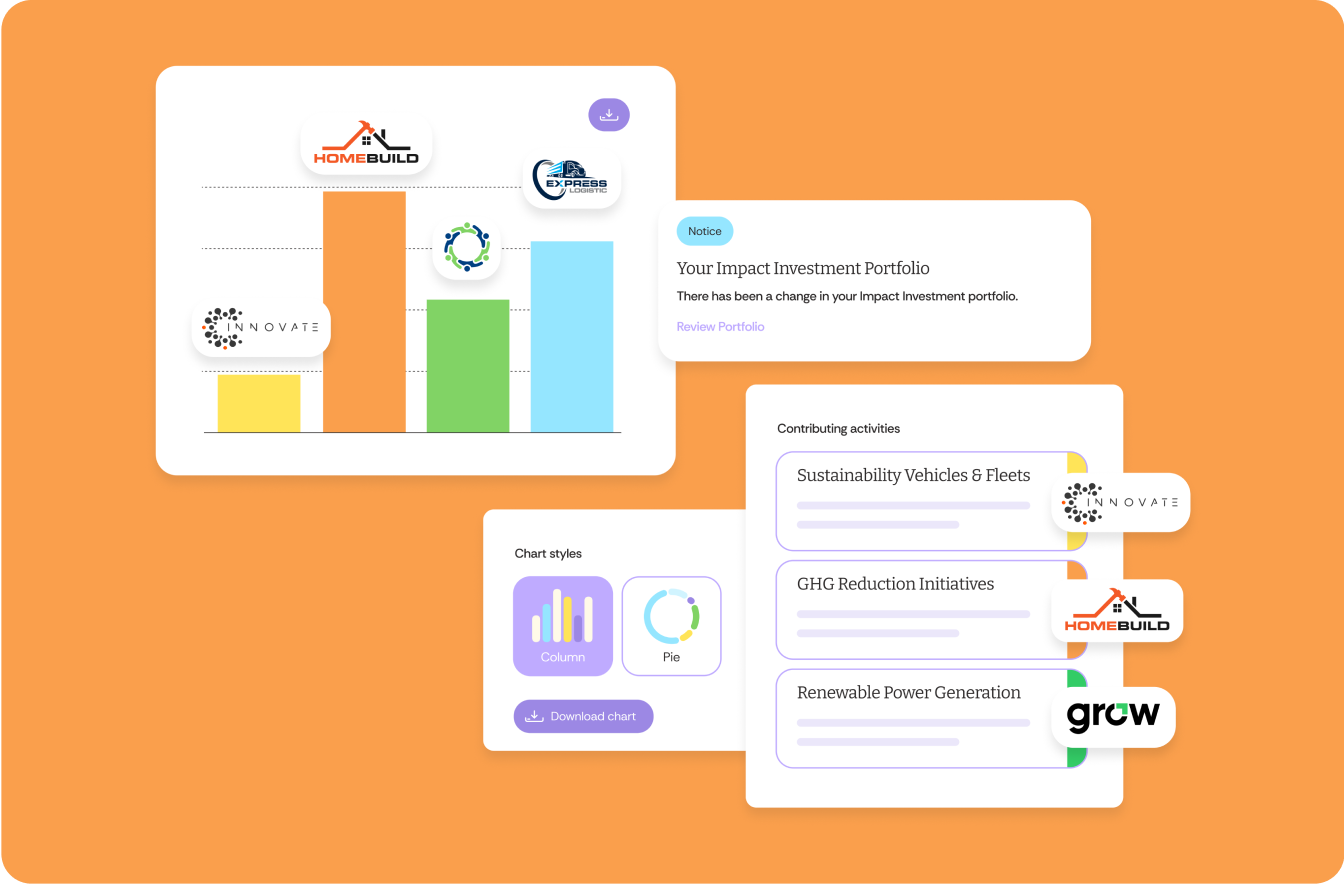

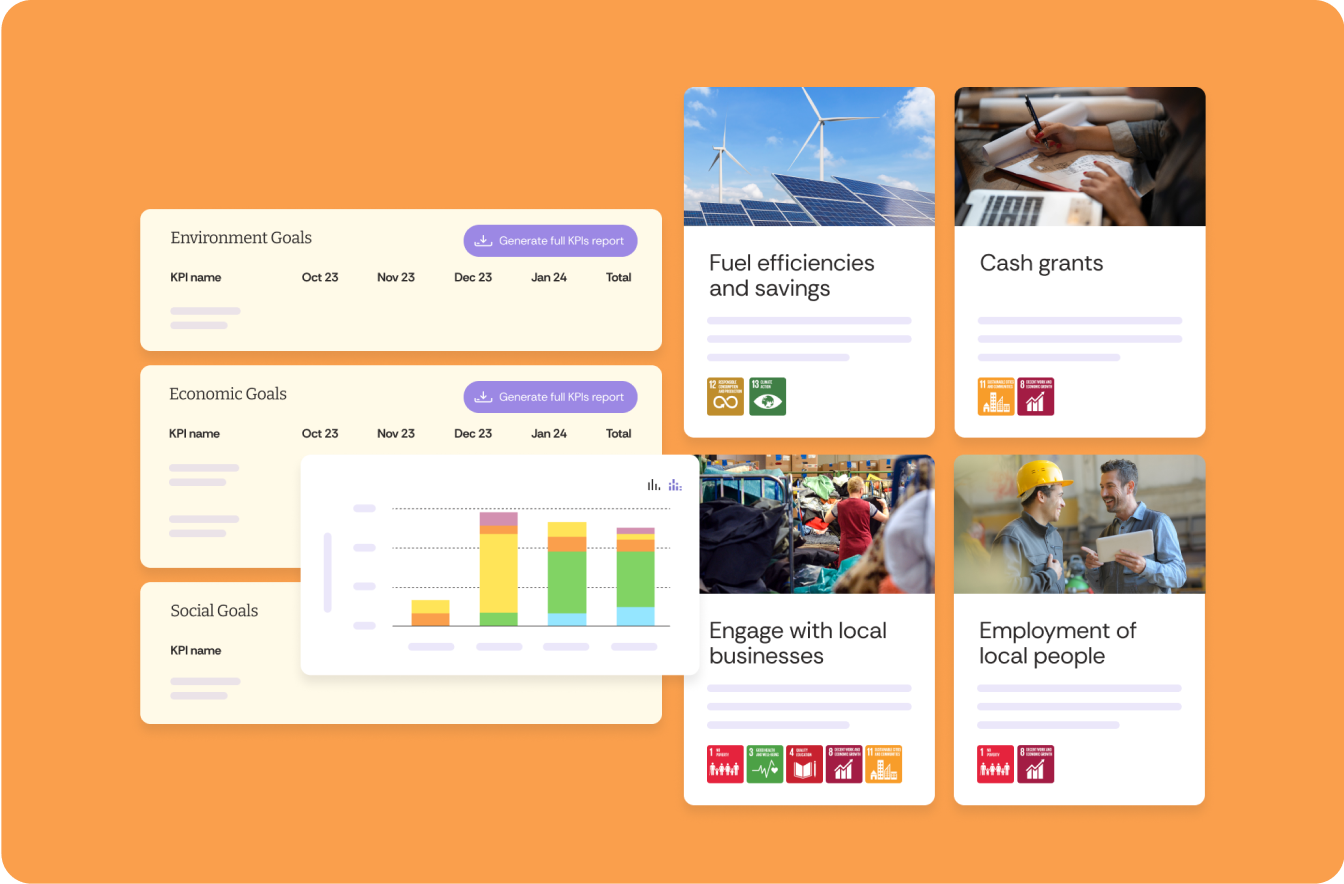

Compare your investments side by side or as a whole, so you can get the complete picture of the social and environmental impact you’re generating.

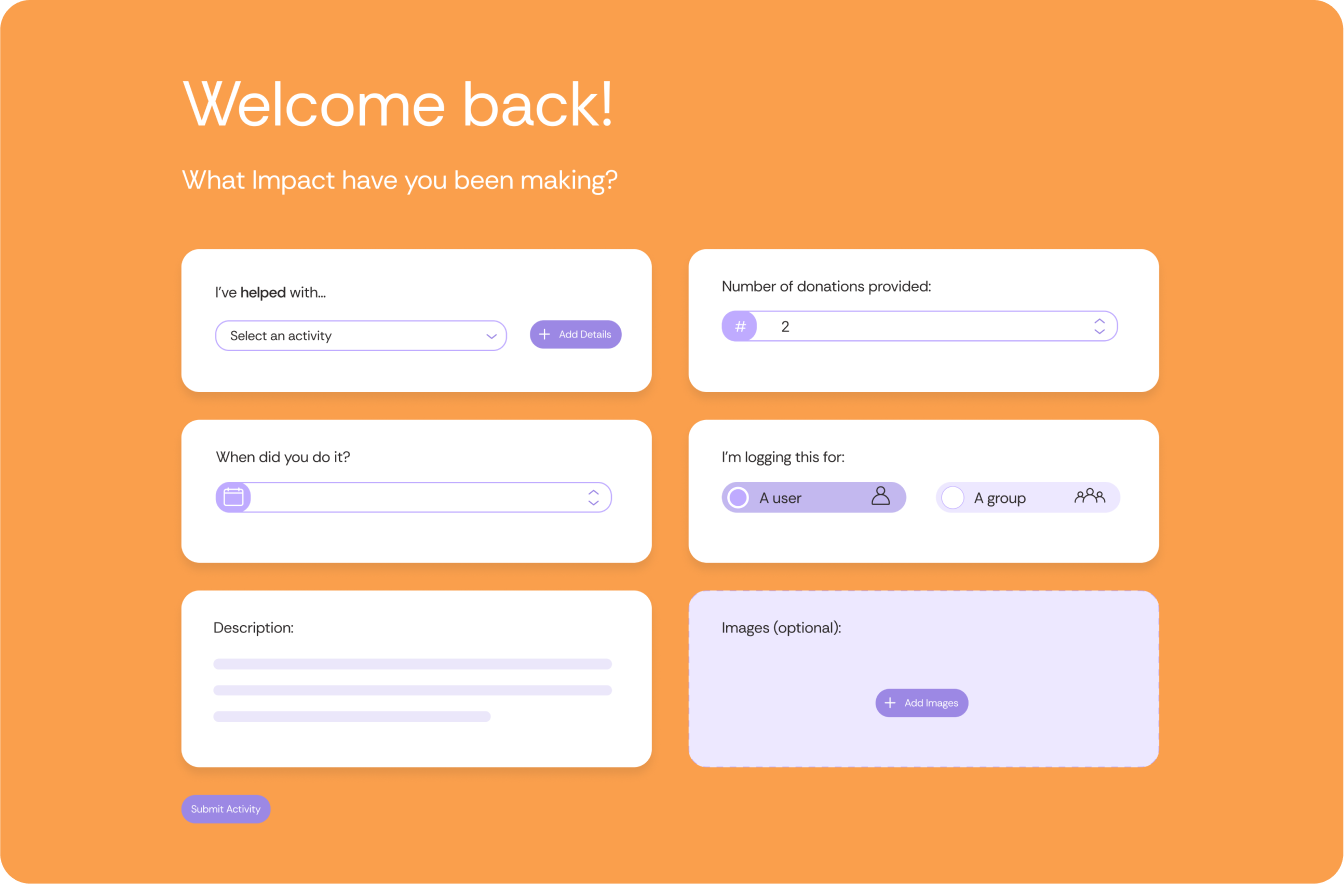

Our survey tool captures the unique contributions your investments make that can’t always be reflected in black-and-white figures.

Whether you align with the Sustainable Development Goals (SDGs), the GRI Standards, or any other framework, you can easily customise our portfolio tracker to understand your successes.

Forget feel-good metrics. Track your performance and report on your growth equity investments using indicators that mean something to you and your stakeholders.

It’s the only way to do business.

Explore how our software captures social impact differently.

In a world of greenwashing, proving the impact of your investment isn’t just a checkbox. It’s our duty.

Impact Reporting turns your investing activity into impactful stories that connect with your stakeholders, showing off the real change you’re making.

Why Impact?

Over a decade ago, Palatine pioneered its environmental, social and governance (ESG) framework and has embedded it across its investment approach and portfolio with the help of Impact.

View case studyNot to be confused with charity or social enterprises, “impact investing” directs capital to enterprises that generate social or environmental benefits as well as a financial return.

The Global Impact Investing Network (GIIN) defines impact investing by four core characteristics: intentionality, investment with return expectations, range of return expectations and asset classes, and impact measurement. These characteristics ensure that investments intentionally contribute to measurable social or environmental outcomes alongside financial returns.

Examples of businesses that would be a great investment with social or environmental benefits could include:

No, impact investing and ESG (Environmental, Social, Governance), while they are related to one another, are different concepts. ESG serves as a set of guiding criteria to evaluate risks and operational performance in investment decisions. In contrast, impact investing is when private equity funds are focused on generating specific, beneficial impacts in addition to financial returns.

In private equity, impact is defined by the tangible social or environmental benefits generated by an investment, which are intentional and measurable and contribute to addressing global challenges.

In private equity, impact investing targets companies that not only promise financial returns but also demonstrate potential for significant social or environmental impacts. Private equity investors may actively engage with these companies to enhance their impact outcomes alongside financial performance.

While impact investing and venture capital can target emerging businesses, impact investing is when investors specifically seek companies with the potential for both financial and non-financial returns. In contrast, traditional venture capital focuses primarily on financial growth and returns.

Investors choose impact investing to align their portfolios with their values, aiming to contribute to societal and environmental improvements while seeking financial returns. Impact investing can be worth it for investors wishing to achieve financial return and positive impact.

Pros include:

Cons involve the potential for higher due diligence costs, lower immediate returns compared to traditional investments, and challenges in measuring impact using traditional frameworks.

Private equity and venture capital managers are well-placed to drive change in business. By working closely with management and supporting a business with capital, expertise and networks, investors have demonstrated that they can drive improved growth and profitability for companies of every size and stage across a very wide range of sectors and geographies.

As an influx of funds surges into impact investment, private equity investors who adopt impact management and measurement strategies are more likely to see better success in their financial, social, and environmental outcomes.

Let’s start doing more good, together.